Expected Default Frequency Model (EDF)Model/KMV Model/ Credit risk/ Credit strength /ICFAI /MAKAUT - YouTube

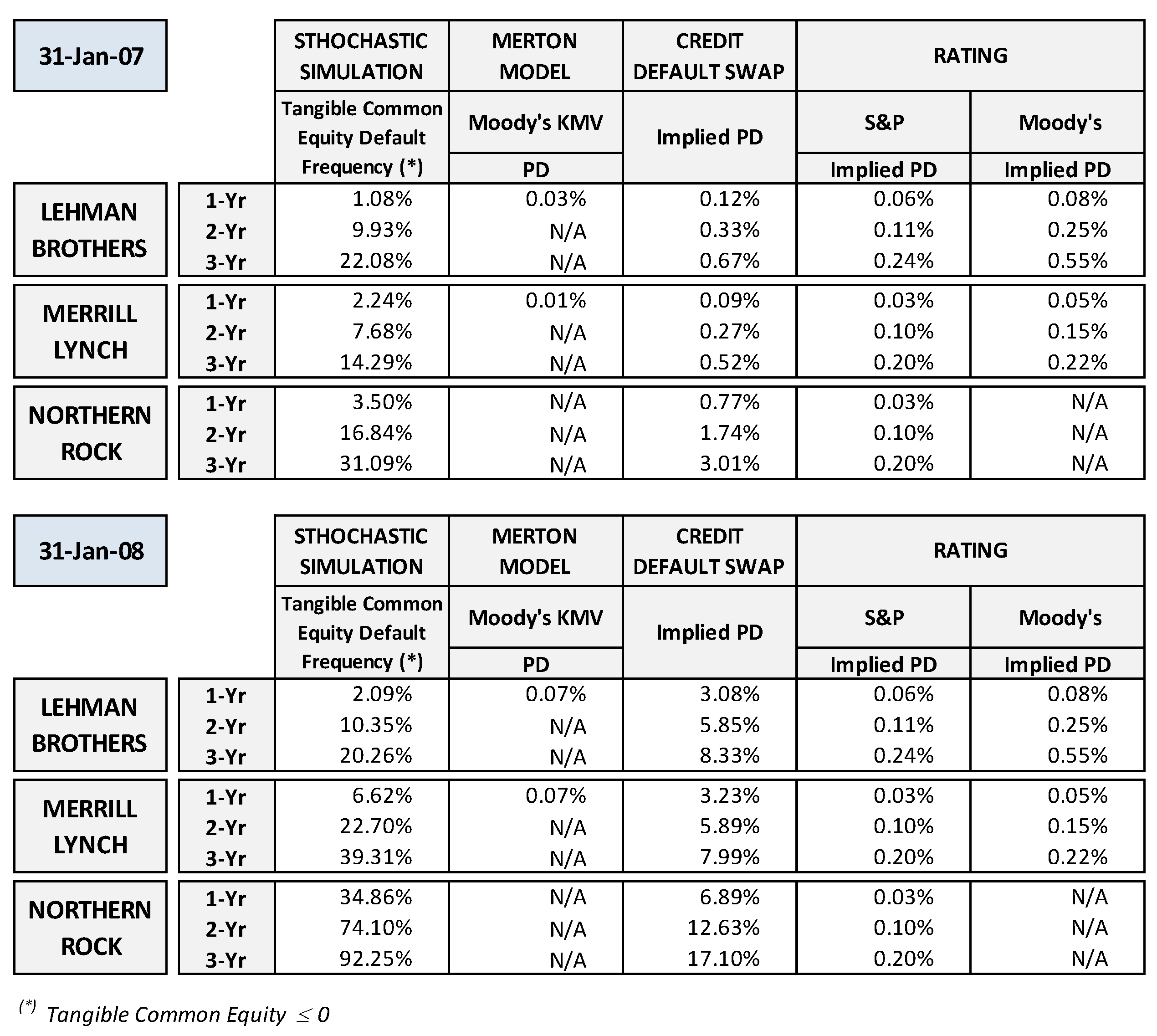

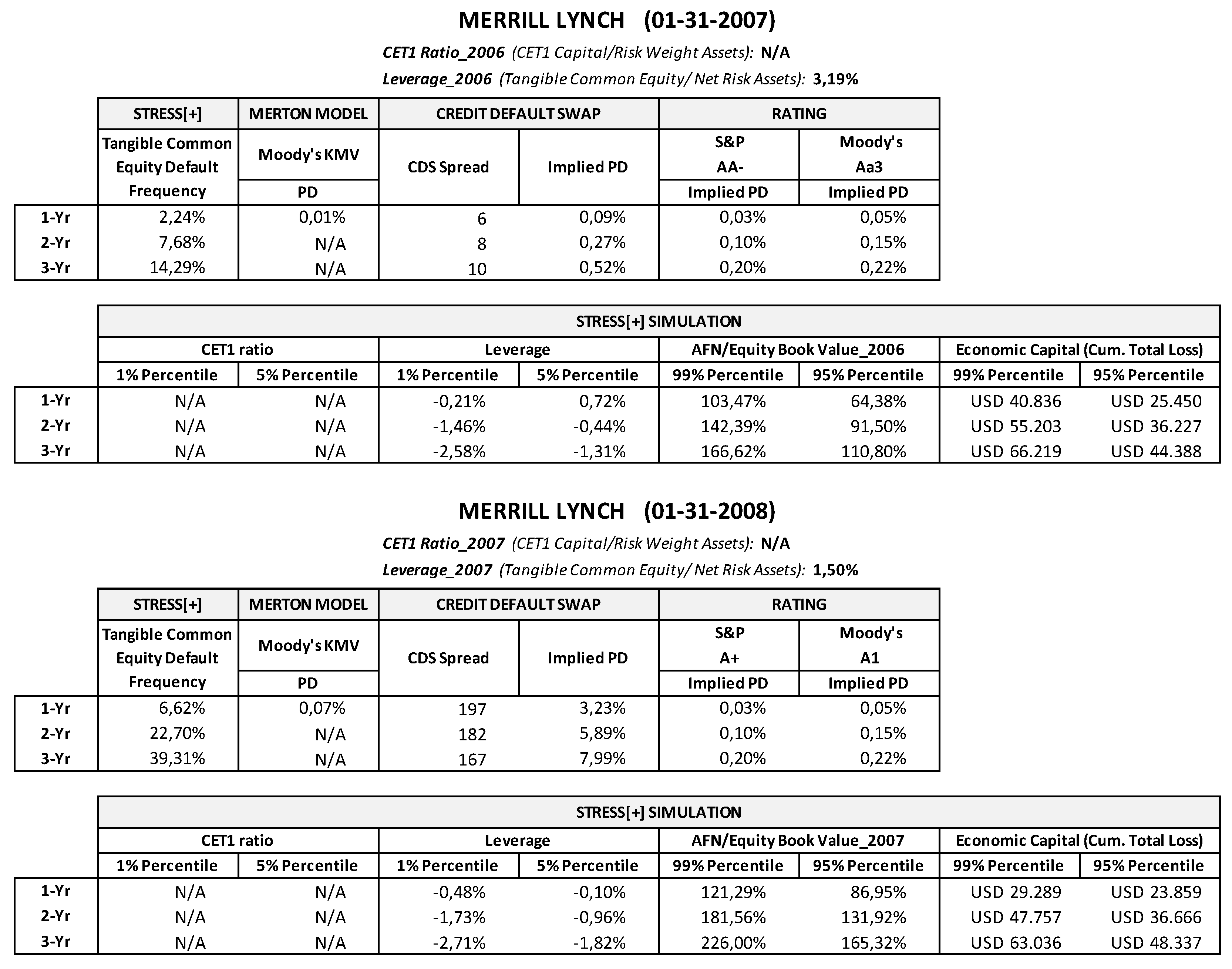

Risks | Free Full-Text | Bank Stress Testing: A Stochastic Simulation Framework to Assess Banks' Financial Fragility †

MULTI-PERIOD LOAN INTEREST RATE NASH MODEL WITH BASEL II SOLVENCY CONSTRAINT – тема научной статьи по математике читайте бесплатно текст научно-исследовательской работы в электронной библиотеке КиберЛенинка

Risks | Free Full-Text | Bank Stress Testing: A Stochastic Simulation Framework to Assess Banks' Financial Fragility †

Unexpected losses comparison of CreditMetrics and KMV models for entire... | Download Scientific Diagram